Red Cat Holdings (Long Thesis)

Future of warfare: Unmanned systems

Executive summary

Red Cat is an emerging US defense drone manufacturer positioned directly in front of two major shifts in global security. Warfare is moving rapidly toward unmanned systems, and rising geopolitical tension is driving structurally higher defense spending across the US and NATO. Red Cat’s platforms across Teal, FlightWave and Blue Ops place it in the slipstream of that demand.

A key catalyst is the US move to restrict Chinese drones. By late 2025 most Chinese drone imports could be blocked, forcing government agencies to pivot toward trusted American suppliers. Red Cat is one of the few smaller companies already approved within DoD and NATO procurement channels, giving it real leverage to this policy driven shift.

Despite this backdrop, the market is valuing the company as if these opportunities will not convert. Yet Red Cat has a strong net cash position, expanding manufacturing capacity, and early traction through programs like SRR Tranche 2 and the NSPA catalogue. If even a portion of expected demand materialises in 2026, the current valuation looks too low.

There is meaningful execution risk, but the combination of industry tailwinds, regulatory catalysts and a mispriced setup makes this a compelling investment opportunity.

Introduction

In 2019, the business underwent a restructuring and adopted the name Red Cat. Since then, Red Cat Holdings Inc and its subsidiaries have developed into a company focused on serving the drone industry. The group provides a range of products and operational solutions that support government customers across different parts of the unmanned vehicle market.

M&A history overview

Rotor Riot (Jan 2020)

Red Cat acquired Rotor Riot for $2 million. The company is a consumer-focused reseller of drones and drone parts sold primarily through its online storefront.

Fat Shark (Nov 2020)

Red Cat bought Fat Shark for $8.4 million. Fat Shark sells FPV electronics, best known for its goggles that give pilots a real-time video feed from onboard drone cameras.

Skypersonic (May 2021)

Red Cat acquired Skypersonic for $2.8 million. Skypersonic provides drones and software for remote inspection, enabling operations in confined or GPS-denied environments.

Teal (Aug 2021)

Red Cat purchased Teal for $10 million. Teal manufactures DoD-approved tactical drones used by the US military for reconnaissance, public safety, and inspection.

FlightWave (Sept 2024)

Red cat acquired FlightWave entirely with its common stock, worth of around $14 million. The Edge 130 propels Red Cat into a new defense and military growth opportunity with the VTOL tricopter, delivering intelligence, surveillance and reconnaissance.

Blue Ops (Aug 2025)

Red Cat Launches Maritime Division, Blue Ops, Inc., Appoints Barry Hinckley as President to Lead Expansion into Uncrewed Surface Vessels

Business segments

Red Cat only has one business segment following the closing and sale of the consumer segment in 2024, consisting of Rotor Riot and Fat Shark to Unusual Machines, Inc. According to the company 10-k: “The sale reflects our decision to focus our efforts and capital on defense where we believe there are more opportunities to create long term shareholder value.”

Rotor Riot and Teal were rolled up in an Enterprise segment.

The Enterprise segment is focused on US federal government agencies, particularity the DoD. The segment is focused on delivering integrated robotic hardware and software for a wide range of mission-critical applications. Its systems provide front-line warfighters, commanders, firefighters, and public safety teams with real-time situational awareness and actionable intelligence. The strategy centers on building and scaling a fully American-made family of unmanned systems.

Subsidiaries

Red Cat has 3 subsidiaries:

Teal Drones: Developing unmanned aircraft systems for the military and law enforcement.

FlightWave: Developing long-range, autonomous VTL drones and sensors.

Blue Ops: Developing uncrewed surface vessel in the marine segment.

What do each of them do?

Teal Drones

The crown jewel of Teal is the Black Widow. It’s a short range reconnaissance drone.

The Teal Black Widow is a rucksack-portable tactical quadcopter designed for short-range reconnaissance missions in contested environments. It weighs about 4.26 lbs and delivers more than 45 minutes of flight endurance with a communication range of roughly five miles. The platform uses a secure AES-256 encrypted link and a frequency-hopping radio system to maintain connectivity in electronic-warfare and jamming-heavy conditions. It is built for rapid field deployment, with a modular architecture that allows arms, payloads and other components to be quickly swapped or repaired by operators.

For sensing, the Black Widow integrates the Hadron 640R+ EO/IR payload, combining a 64-megapixel electro-optical camera with a Boson+ 640 radiometric thermal sensor to provide high-resolution imaging in both daylight and low-visibility conditions. The aircraft can operate in GPS-denied environments through visual-inertial odometry and onboard autonomy software, enabling navigation even when satellite signals are disrupted. It also supports pre-loaded mission execution with a low-signature “stealth mode” that lets the drone operate without emitting active communications.

FlightWave

The Edge 130 Blue is a lightweight military-grade VTOL tricopter designed to combine vertical takeoff with efficient fixed-wing flight.

Weighing about 2.65 lbs with a 130 cm wingspan, it can be assembled and launched by a single operator in roughly one minute. In forward flight the aircraft delivers more than two hours of endurance, while hover-only missions achieve around 30 minutes. Its cruise speed is approximately 15 m/s with a top speed near 27 m/s, and it can operate up to roughly 12,000 ft above sea level. The airframe uses FlightWave’s tilt-pod system to transition smoothly between hover and forward flight without interrupting operations and is designed to tolerate wind speeds of around 17 m/s.

For sensing and mission flexibility, the Edge 130 Blue supports quick-swap, Blue-UAS-approved payloads including EO/IR gimbals and mapping modules. Payloads can be interchanged without tools, enabling rapid reconfiguration in the field. Communications are encrypted using AES-level security, and the aircraft maintains secure, long-range connectivity through its tactical radio system. The platform’s modularity, VTOL capability and long endurance make it suitable for ISR missions requiring both vertical lift and efficient fixed-wing coverage within a compact, deployable system.

Blue Ops

The Variant 7 is a modular, expeditionary uncrewed surface vessel (USV) developed by Red Cat’s maritime division, Blue Ops, to provide long-endurance ISR and multi-mission capability. Measuring roughly seven meters in length and designed for rapid deployment, it delivers more than 60 hours of unmanned endurance with an operational range approaching 800 nautical miles depending on payload. The craft can exceed 39 knots in high-performance mode and maintains cruising speeds in the low-20-knot range, supported by a lightweight composite hull optimized for fast production. With a payload capacity of up to about 650 kg, the platform can be configured for ISR, strike, anti-ship, logistics, or UAV launch-and-recover roles, with mission kits and sensor packages swapped quickly without specialized tools.

For sensing and autonomy, the Variant 7 accommodates EO/IR modules, radar payloads, and maritime situational-awareness systems compatible with Blue-UAS requirements. The autonomy stack enables waypoint navigation, obstacle avoidance, and semi or fully autonomous mission execution, with encrypted communications designed to remain resilient in electronic warfare heavy maritime environments. The vessel is built for coastal and near-shore missions where small-form-factor unmanned systems offer tactical advantage. Overall, the Variant 7 delivers a compact, long-range and highly modular surface platform suited for naval ISR, coastal defense and unmanned operations.

Financials

(NASDAQCM:RCAT) is currently trading at around $7.3 per share, with 119 million shares outstanding the current market cap is around $892 million. The company has $206 million in cash and about $24 million in total debt, the EV is $709 million, which is lower than the market cap as the cash position is positive.

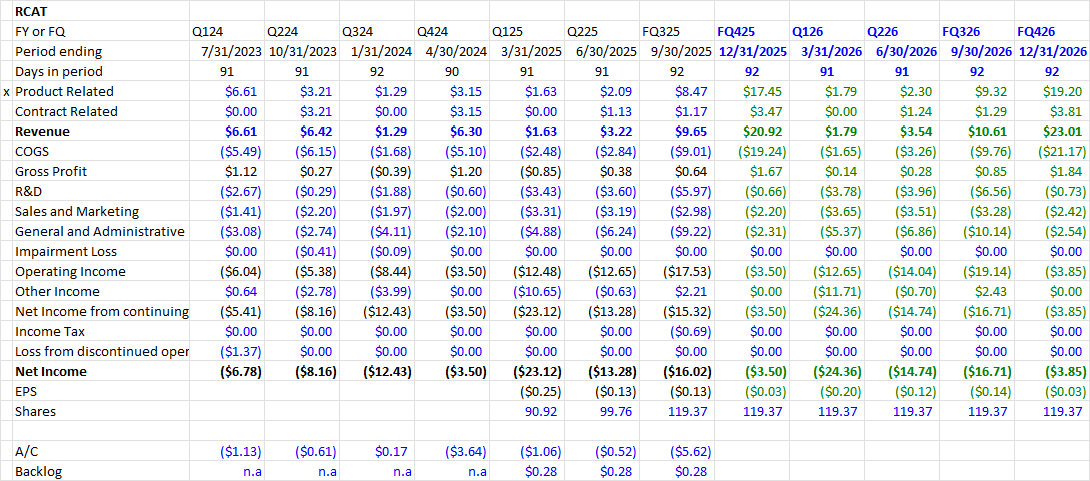

For financial year 2024 RCAT achieved $20.63 million in revenue. Gross profit was $2.2 million as COGS was -$18.43 million. The company is far from becoming profitable (we’re taking years) and made a loss of -$30.87 million in 2024. In 2025 the net loss is estimated to increase to -$55.91 million.

Modelling out the future earnings of RCAT is not a simple task. As you can see the quarter to quarter revenues fluctuations are ridiculous and unpredictable in the short term. Since the revenues depend on the government contracts and those are won or lost on unpredictable basis its difficult to estimate, Red Cat also does not provide detailed breakdown of their segments and unit deliveries of each type of drone they sell.

Looking at the balance sheet, the company is at a strong cash position. RCAT recently completed a stock offering, issuing 17,968,750 shares in total raising and $172.5 million. Currently, cash on the balance sheet is $206,425,996 and total debt is $23.8 million, net cash position is $183 million. The company burned though $30.87 million in FY2024, meaning assuming a flat projection RCAT can sustain its losses for around 6 years.

Valuation

Per Capital IQ Pro, Red Cat is currently trading at 19.81 TEV/Revenue 2025FY and at 4.92x TEV/Revenue 2026FY and 3.88x TEV/Revenue 2027 this looks cheap to me. The reason the sudden drop off in the multiple is the uncertainty of the future revenues. But I think the 2026 outlook for RCAT is very positive.

RCAT is trading at 19.51x EV/Sales (FWD) which is lower than UMAC which is trading at 23.60x but much larger than KTOS (9.3x), AVAV (7x) and TDY (4x). Although, this higher multiple is more than justified because of the infancy of RCAT and the current revenue growth rates. Q3 they reported revenue growth of 646% year over year and currently guiding to Q4 Revenue to 1455% year over year.

Red Cat recently launched a maritime division, Blue Ops, focused on delivering and further developing a family of battle proven uncrewed surface vessels (USV) weapons systems. The US Army’s SRR UAS Tranche 2 program, signed in July 2025 has been expanded and is now valued at $35 million. Blue Ops opened a 155,000 square foot facility in GA with manufacturing capacity of more that 500 vessels per year and a 2x expansion of manufacturing space in Salt Lace City for the (Teal) drone and LA (FlightWave) Facilities. The management sounds excited and position going into 2026: “Our record-breaking third quarter revenue and the expansion of our contract with the U.S. Army clearly demonstrates the accelerating adoption of our specialized solutions within the defense and national security sectors,” said Jeff Thompson, CEO of Red Cat.

Overall, 2026 appears poised to be a year of strong growth and substantial upside for RCAT. The market is currently applying a significant discount due to uncertainty, which in my view creates an attractive entry point at the current share price, especially given the recent sell-off.

Risks

Ukraine war seems to be coming to and end and this news is likely to hit the defense stocks worldwide as defence spend in the US and EU come under uncertainty. I think the defence spend will not be impacted with this news but the stock will have a short term pullback.

Execution risks remain present as defence is a difficult industry to make money in as you’re depended on government contract based on approvals granted and alot of sunk costs made into manufacturing facilities. RCAT management has proven to be very effective navigating these challenges effectively evidenced by “Black Widow” the small uncrewed aerial system (sUAS) approved and added to the NSPA catalogue and the DoD and homeland security agency contracts. This means NATO member nations (and eligible partners) will be able to procure Black Widow through standard procurement channels.

RCAT operates within a highly competitive drone and defense landscape dominated by established players such as AeroVironment, Skydio, Anduril, Teledyne, and several major NATO and United States defense contractors. These larger firms benefit from greater research and development budgets, stronger manufacturing infrastructure, and long standing relationships with the DoD and homeland security agencies. In this environment, RCAT’s smaller scale and shorter track record make it more difficult for the company to compete for large multiyear government contracts.

Catalysts

Major catalysts for RCAT would be a ban on Chinese made drones. Western governments are moving quickly to restrict or ban drones made in China, especially those produced by DJI. Under the 2025 National Defense Authorization Act, new imports of many Chinese drones will be blocked in the United States by December 2025 unless they pass a security review that has not begun. The US Commerce Department is also preparing new national security rules that would further limit Chinese drone imports. As these restrictions tighten, government and security agencies will need Western built alternatives. This creates a clear opportunity for companies like RCAT, since demand will naturally shift toward trusted suppliers that meet United States and NATO security standards.

The conversion of its announced government opportunities into firm, repeat orders, would act as a positive and confidence inspiring catalyst. A meaningful production contract under the Army’s Short Range Reconnaissance program would signal that the company has moved beyond prototypes and small awards into genuine DoD backed volume. Additional federal demand from border security, special operations units, or other agencies would reinforce that momentum.

Another catalyst is the first wave of actual purchases from NATO countries following the company’s recent inclusion in the NSPA procurement catalogue. One or two sizeable orders from European allies would validate the platform internationally and demonstrate that the NSPA listing is translating into revenue rather than remaining a theoretical channel.

Finally, any improvement in RCAT’s financial position, such as reduced cash burn, higher margins through scale, or evidence of stable recurring service revenue, would help reduce investor concerns about dilution and strengthen confidence in the long term outlook.

Conclusion

RCAT appears to offer a compelling investment setup supported by several structural tailwinds. Warfare is steadily shifting toward robotics and unmanned systems, and Western governments are increasingly restricting Chinese built technology while promoting domestic suppliers. RCAT is aligning itself with these trends by expanding into new areas such as its maritime division and by exiting consumer focused segments that distract management from higher value defense work. The recent selloff provides an attractive entry point at a moment when the company is sharpening its strategic focus and positioning itself for growth in a sector that is only becoming more important. Taken together, the industry tailwinds, the shift away from Chinese systems, RCAT’s streamlined strategy and the current valuation create a genuinely interesting opportunity for investors.

“That’s it! Thank you for reading! You can subscribe and like to support my research. Please reach out if you have any questions or if you want to chat about markets.“

Disclaimer: The content published here represents my personal opinions and is provided strictly for informational and educational purposes. Nothing on this Substack constitutes financial, investment, legal, or tax advice, nor should it be relied upon as such. I am not a licensed financial advisor, and I do not make recommendations to buy, sell, or hold any securities. The information presented may not be complete or accurate, and it may change without notice. Past performance is not indicative of future results. You are solely responsible for your own investment decisions, and you should always conduct your own research or seek advice from a qualified professional before making financial decisions. I may hold positions in securities mentioned, but I am under no obligation to update or disclose changes.

Interesting dive, gonna bookmark for a deeper read thanks for sharing this